How the UK Government Has Handled the HRP State Pension Shortfall (1978–2025)

Introduction

Home Responsibilities Protection (HRP) was introduced to ensure that parents and carers who took time out of paid work were not penalised when they reached State Pension age. HRP ran from 6 April 1978 until 5 April 2010, when it was replaced by National Insurance (NI) credits. Official GOV.UK guidance confirms the purpose and timeline of HRP, and how it interacted with Child Benefit and care-related entitlements (see ‘Home Responsibilities Protection – Overview’ on GOV.UK: https://www.gov.uk/home-responsibilities-protection-hrp and ‘What you’ll get’: https://www.gov.uk/home-responsibilities-protection-hrp/what-youll-get).

However, a long‑running administrative problem meant HRP was not always recorded correctly on people’s NI records — most commonly for mothers who claimed Child Benefit before May 2000 when the forms did not consistently capture the claimant’s NI number. This led to underpaid State Pensions for some retirees decades later.

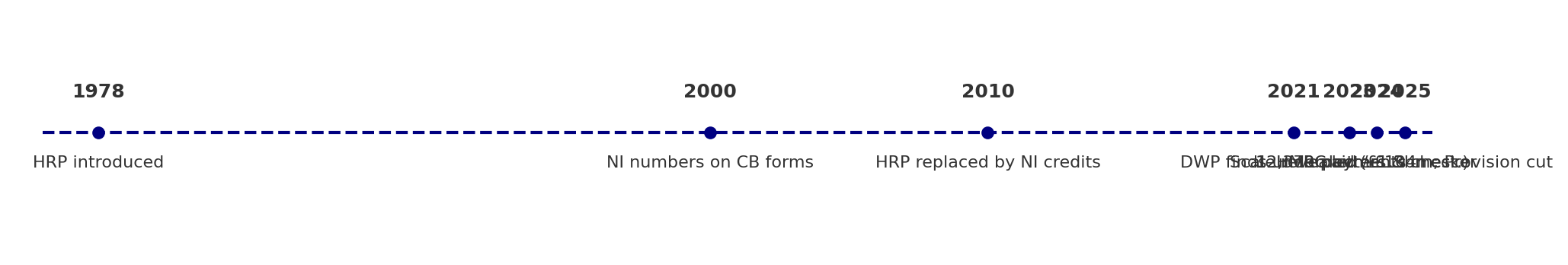

Timeline: How We Got Here

1978: HRP begins

From 6 April 1978, HRP reduced the number of qualifying NI years needed for a full basic State Pension for parents and carers. The scheme protected those who were receiving Child Benefit for a child under 16 or caring for someone on Income Support. Reference: GOV.UK ‘HRP – Overview’: https://www.gov.uk/home-responsibilities-protection-hrp and ‘What you’ll get’: https://www.gov.uk/home-responsibilities-protection-hrp/what-youll-get.

2000: Child Benefit forms start capturing NI numbers

From May 2000, Child Benefit claim forms began routinely capturing the claimant’s National Insurance number, which reduced the risk of HRP not being linked to the right person. This change is referenced in GOV.UK materials (see HRP pages above) and later HMRC communications resources for stakeholders: https://www.gov.uk/government/publications/home-responsibilities-protection-communication-resources.

2010: HRP replaced by NI credits

On 6 April 2010, HRP was replaced by National Insurance credits for parents and carers. Those who had earlier years protected by HRP kept that protection. Reference: GOV.UK HRP overview/eligibility pages: https://www.gov.uk/home-responsibilities-protection-hrp/eligibility and ‘What you’ll get’: https://www.gov.uk/home-responsibilities-protection-hrp/what-youll-get.

2021: Underpayments identified in DWP checks

During State Pension review work (LEAP exercises) the Department for Work and Pensions (DWP) identified that some National Insurance records were missing historic HRP periods. This was highlighted in subsequent DWP reporting and paved the way for a coordinated correction exercise.

2023: Scale acknowledged; joint plan announced

In 2023, DWP’s Annual Report and Accounts acknowledged the scale of potential HRP underpayments and set out plans to work with HM Revenue & Customs (HMRC) to identify and contact people who might be affected. See ‘DWP annual report and accounts 2022 to 2023’ (HTML landing page): https://www.gov.uk/government/publications/dwp-annual-report-and-accounts-2022-to-2023/dwp-annual-report-and-accounts-2022-to-2023.

Late 2023–2024: HMRC letters and online checker

Between December 2023 and September 2024 HMRC sent letters to people identified as potentially missing HRP, prioritising those already over State Pension age. HMRC also launched an online eligibility checker and application journey on GOV.UK, while keeping a postal route (form CF411) and helpline available. References: HMRC/DWP news release ‘Check you’re not missing State Pension payments’ (12 Sept 2024): https://www.gov.uk/government/news/check-youre-not-missing-state-pension-payments and HMRC’s ‘HRP communication resources’ hub: https://www.gov.uk/government/publications/home-responsibilities-protection-communication-resources. The application guidance and online journey are here: ‘Apply for Home Responsibilities Protection’: https://www.gov.uk/guidance/apply-for-home-responsibilities-protection and CF411 notes (PDF): https://assets.publishing.service.gov.uk/media/639b033fd3bf7f7f8e54ddcd/CF411_Notes.pdf.

November 2024: First published progress figures

On 7 November 2024, DWP and HMRC published the first joint progress update for the HRP correction exercise (‘LEAP’), providing management information on letters sent, applications received and cases processed to 30 September 2024. See GOV.UK collection page: https://www.gov.uk/government/publications/home-responsibilities-protection-hrp-state-pension-underpayments-progress-on-cases-reviewed-to-30-september-2024.

May 2025: Latest progress to 31 March 2025

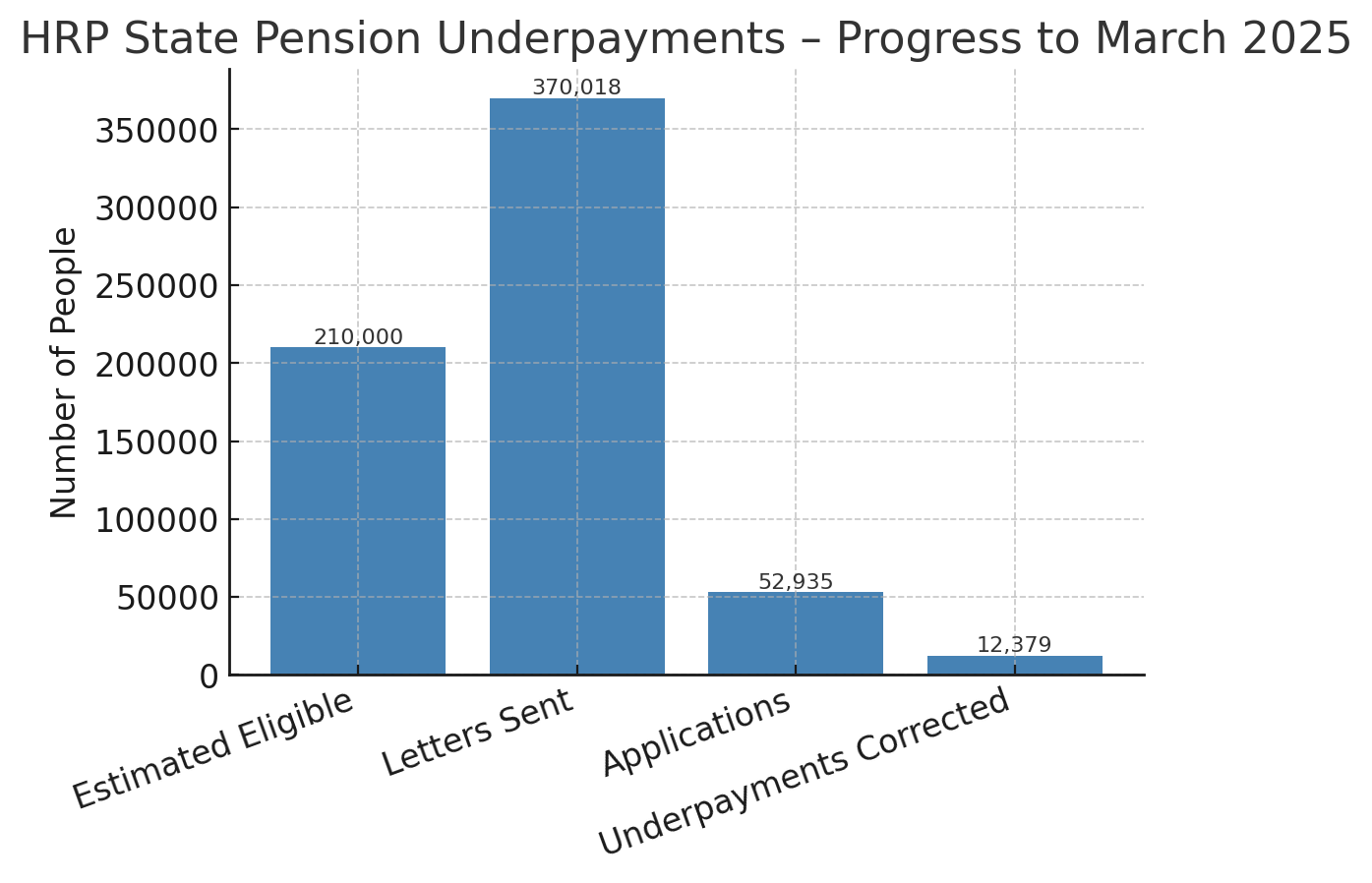

On 22 May 2025, DWP published updated figures on cases reviewed up to 31 March 2025. Headline numbers included:

• 12,379 confirmed State Pension underpayment cases corrected; around £104 million paid in arrears so far; average arrears about £8,377 per person.

• 370,018 letters issued by HMRC (Dec 2023–Sept 2024 phase complete) and 52,935 applications processed.

See ‘HRP State Pension underpayments: progress on cases reviewed to 31 March 2025’ (GOV.UK): https://www.gov.uk/government/publications/home-responsibilities-protection-hrp-state-pension-underpayments-progress-on-cases-reviewed-to-31-march-2025.

Where We Are Now (and What It Means)

Taken together, the official updates show that a significant number of people have now had their pensions corrected — which is positive — but that this represents only a fraction of those potentially affected. Earlier DWP materials and commentary indicated that the total population with missing HRP could be in the hundreds of thousands (predominantly mothers who claimed Child Benefit before 2000). The May 2025 progress release (above) confirms that the exercise has paid substantial arrears to date, but also underscores how many have yet to claim or be identified.

Key Numbers at a Glance

• Eligible population (historic estimate): around the low-to-mid hundreds of thousands (primarily those who claimed Child Benefit pre‑2000 and some carers). Use narrative only here — avoid quoting an exact historic estimate unless linking to the specific DWP report.

• Letters sent: 370,018 (Dec 2023–Sept 2024). Source: 22 May 2025 DWP progress update: https://www.gov.uk/government/publications/home-responsibilities-protection-hrp-state-pension-underpayments-progress-on-cases-reviewed-to-31-march-2025.

• Applications processed: 52,935 (to 31 March 2025). Same source as above.

• Underpayments corrected: 12,379 (arrears paid ≈ £104m; average arrears ≈ £8,377). Same source as above.

How People Can Check and Claim

Anyone who thinks they might be affected — for example, parents who claimed Child Benefit before May 2000 and can’t see HRP reflected in their NI record — can check and apply via GOV.UK. The routes are:

• Online checker and application (‘Apply for Home Responsibilities Protection’): https://www.gov.uk/guidance/apply-for-home-responsibilities-protection

• Postal application (form CF411) — see CF411 notes (PDF) for evidence requirements: https://assets.publishing.service.gov.uk/media/639b033fd3bf7f7f8e54ddcd/CF411_Notes.pdf

• HMRC National Insurance helpline (details on the GOV.UK pages above).

HMRC also maintains a ‘communication resources’ hub with plain‑English explainer materials that support take‑up: https://www.gov.uk/government/publications/home-responsibilities-protection-communication-resources.

👉 Call to action for readers: [Check your eligibility now] https://evanshaw.co.uk/carer/check-now/

What’s Gone Well — and What Hasn’t

What’s Working

• **Formal recognition and public updates** — The government has acknowledged the problem and is publishing rolling progress updates on GOV.UK (latest to 31 March 2025: https://www.gov.uk/government/publications/home-responsibilities-protection-hrp-state-pension-underpayments-progress-on-cases-reviewed-to-31-march-2025). That transparency matters for people deciding whether to apply.

• **Multiple routes to claim** — People can apply online or by post (form CF411), and HMRC’s NI helpline can support those uncomfortable with digital. References: Apply page https://www.gov.uk/guidance/apply-for-home-responsibilities-protection and CF411 notes PDF above.

• **Material corrections achieved** — Over £100m has been paid in arrears to more than 12,000 people, with average arrears of ~£8,377 (DWP progress update, 22 May 2025).

Where It Fell Short

• **Awareness and comprehension barriers** — Many pensioners were unsure whether HMRC letters applied to them, or were wary of scams. Government communications have improved (see the stakeholder pack: https://www.gov.uk/government/publications/home-responsibilities-protection-communication-resources), but trusted third‑party amplification remains crucial.

• **Start‑up delays** — Underpayments were identified in 2021; letters began late 2023. Given the age of many affected, even short delays matter.

• **Historic data gaps** — Some pre‑2000 Child Benefit records were not retained, limiting HMRC’s ability to pinpoint every eligible case. This is one reason the campaign also asks people to self‑identify via GOV.UK (news release: https://www.gov.uk/government/news/check-youre-not-missing-state-pension-payments).

Policy Adjustments in 2025

In 2025, DWP confirmed this has moved from a one‑off ‘exercise’ into an ongoing programme, so eligible people are not cut off by an arbitrary deadline. Readers should expect the GOV.UK progress page to be updated periodically as more cases are identified and processed.

What to Expect Next

• Continued processing by HMRC/DWP of claims and evidence submitted via the online and postal routes.

• Ongoing public communications encouraging parents (especially those who claimed Child Benefit before May 2000) to check their NI record.

• Periodic management‑information updates on GOV.UK summarising letters issued, applications processed, and arrears paid (see progress page above).

• Integration of HRP checks into routine handling for those approaching State Pension age, reducing the risk of future misses.

Conclusion

The HRP issue stems from historical record‑keeping limitations, but the impact is very present for today’s retirees. The government’s 2024–2025 communications and processing work have delivered meaningful corrections — thousands of people have had their pensions uplifted and received arrears. Yet many eligible people likely remain unaware or uncertain. The practical challenge now is reach and reassurance: getting clear messages to the right individuals, via trusted channels, and supporting them through a simple application process. If you, a friend or a family member claimed Child Benefit before May 2000 (or provided qualifying care) and your NI record appears to be missing HRP, it is worth checking.

👉 Final CTA: https://evanshaw.co.uk/carer/check-now/