Name Changes & Split NI Records: How to Re‑Link Your History

A large share of HRP issues are simple record‑linking problems. If you married, divorced, or changed your name between 1978–2010, parts of your Child Benefit/HRP history can sit under different identifiers. Re‑linking your identity trail helps DWP/HMRC recognise protected years.

What causes a split record

- Marriage/divorce name change not linked to your NI record.

- Different addresses across Child Benefit and NI systems.

- Typos in date of birth or name, or inconsistent spellings.

Your re‑link checklist

- Proof of identity: passport or driving licence.

- Name‑change evidence: marriage certificate, decree absolute, deed poll (with date).

- Address history: bills, tenancy or mortgage statements bridging the years.

- Child Benefit letters that show claimant names and dates.

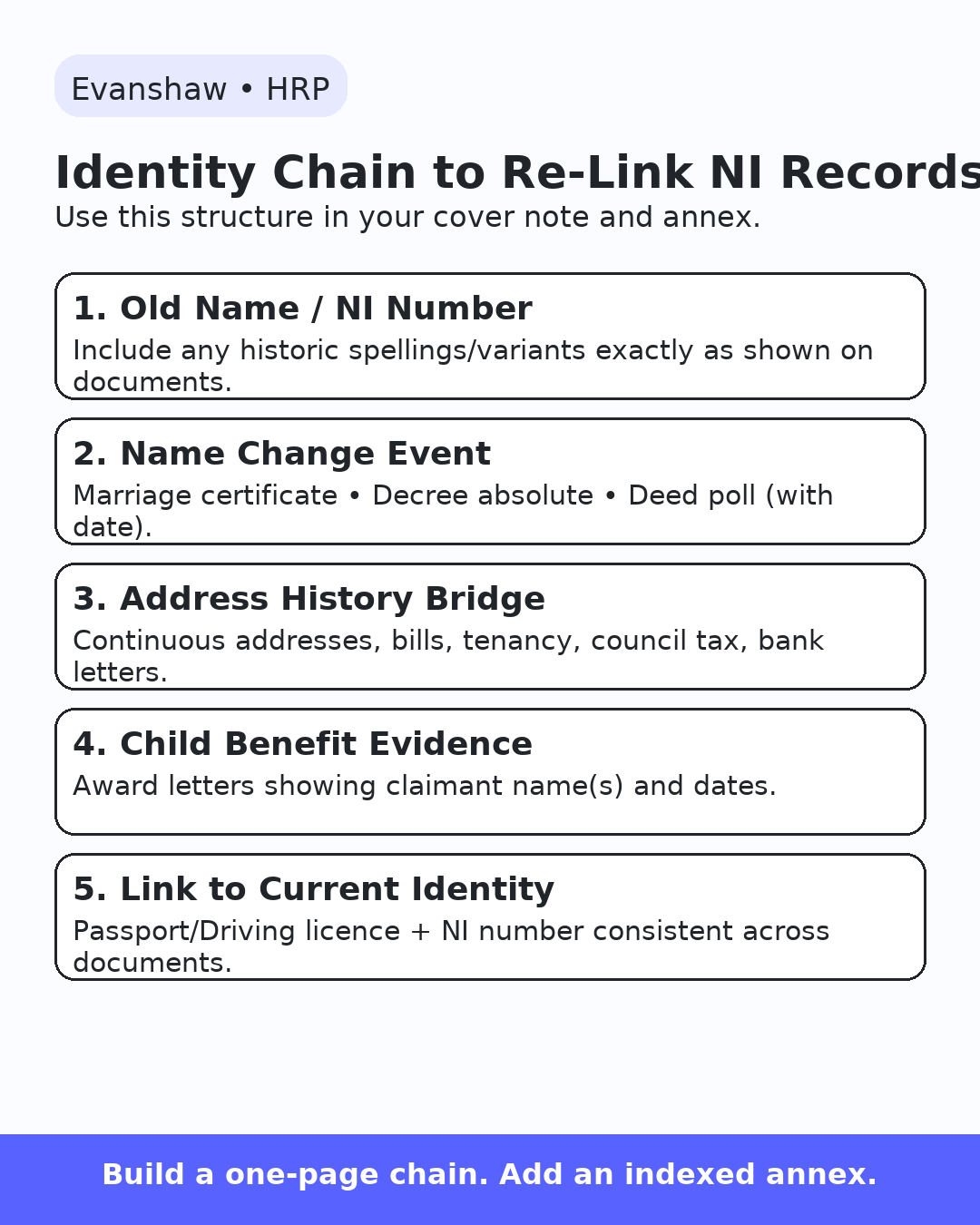

Presenting the identity chain

Create a one‑page ‘identity chain’ that shows: Old Name → (marriage/deed poll on DATE) → New Name → NI number constant. Reference exhibits with simple codes (C1, C2…) and include an indexed annex.

Building your annex (recommended structure)

- Annex A: Identity proof and name‑change documents (C‑series).

- Annex B: Address history bridging documents (utility bills, council tax, bank letters).

- Annex C: Child Benefit claimant evidence per year (A‑series).

- Annex D: Any employment/self‑employment context for those years (D‑series).

Tip: The clearer your chain and annex index, the faster a case‑worker can verify your HRP years.

What to expect after re‑linking

- DWP/HMRC reassess HRP eligibility using the corrected identity mapping.

- If approved, NI records update and your State Pension forecast follows.

- You may get questions if dates or names still conflict — reply with the document code references.

Need help assembling the chain and annex? Evanshaw can build a clean, date‑anchored package for you. Start your secure upload today.