HRP and Pension Credit — What Changes When Your State Pension Goes Up?

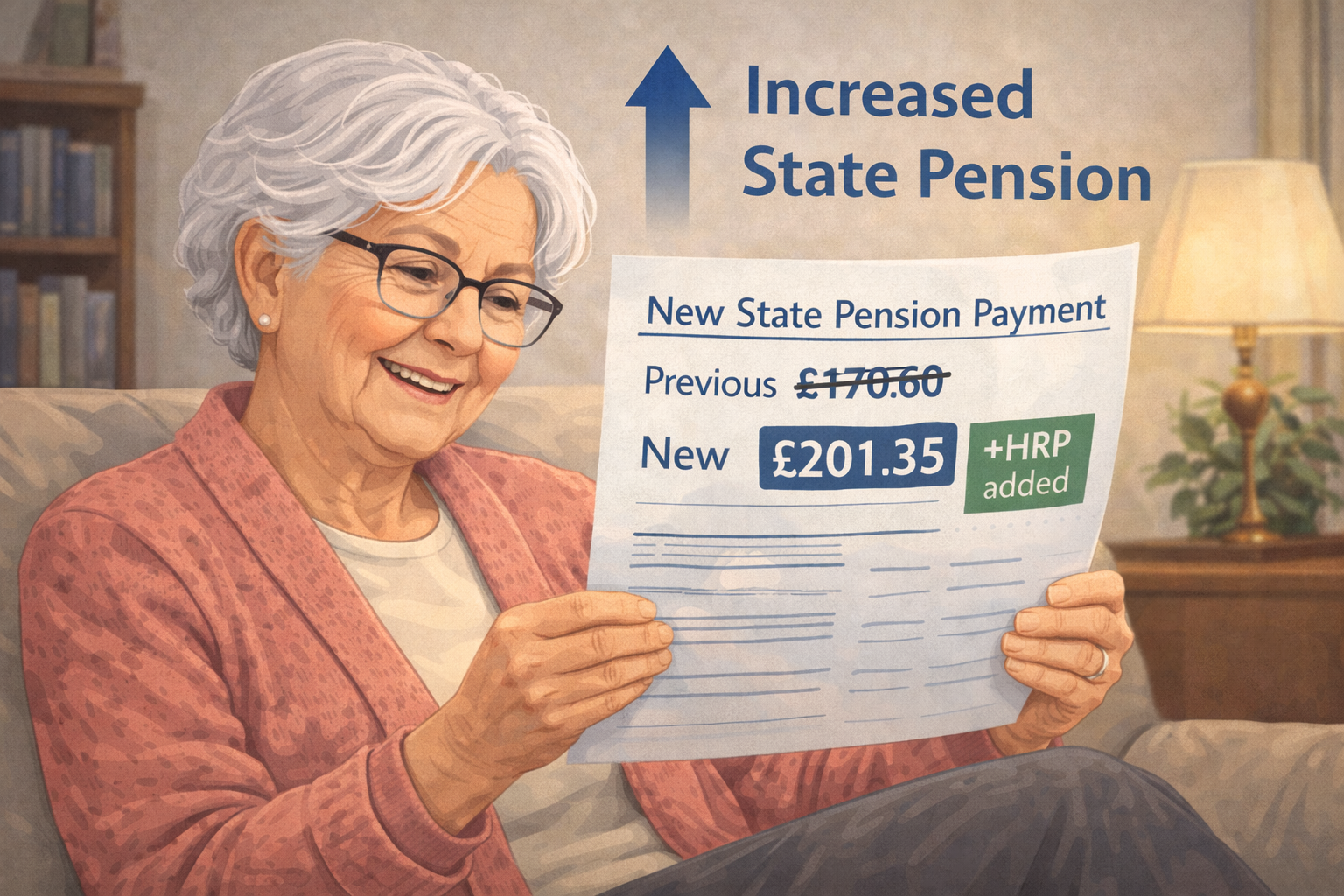

When missing Home Responsibilities Protection (HRP) is added to your National Insurance record, your weekly State Pension can increase and you may receive backdated arrears. If you receive Pension Credit or other income-related benefits, you must report the change. This guide explains what typically changes and how to stay compliant.

Quick definitions

• State Pension — weekly amount from DWP based on your National Insurance record.

• Pension Credit (PC) — income-related top-up for pension-age households (Guarantee Credit; some people also have Savings Credit).

• Arrears — a one-off payment of money owed for past underpayments once HRP is credited.

What changes after HRP is added

1) Weekly pension may increase — DWP recalculates your entitlement once HRP adds qualifying years.

2) Arrears may be paid — a lump sum covers the period you were underpaid.

3) Pension Credit may be affected — your income figure changes; you must notify PC of the new weekly pension.

Reporting: who to tell and when

• Tell Pension Credit (DWP) as soon as your award letter shows a new weekly pension. Provide the letter or screenshot if asked.

• Tell your local authority if you receive Housing Benefit or Council Tax Reduction based on income.

• Keep copies of all letters, uploads, and phone logs. Note the date the new weekly amount starts.

Examples — how Pension Credit can change (illustrative only)

Example A: Weekly pension rises by £10/week. If your Pension Credit Guarantee Credit was topping you up, the PC amount may drop by the same £10/week. Your total weekly income stays broadly the same, but more comes from State Pension and less from PC.

Example B: Larger increase and arrears. If HRP adds several qualifying years, your pension could rise by £30/week and DWP may also pay arrears for past underpayments. Pension Credit assesses ongoing weekly income; arrears are usually treated separately. Always notify DWP so records align.

Practical checklist (keep it simple)

• File the HRP decision or award letter and the revised State Pension award letter together.

• Record the effective date when the new rate starts.

• Notify Pension Credit with the new weekly figure and effective date.

• If you receive Housing Benefit or Council Tax Reduction, send them the same update.

• Review your next Pension Credit decision notice to ensure figures match your new pension.

Common pitfalls (avoid these)

• Not reporting the new weekly amount.

• Mixing arrears with weekly income — arrears are a lump sum; PC assesses ongoing income.

• Buying Class 3 before HRP — HRP may remove the need to pay.

• Missing identity or address links — keep bridging documents together for future corrections.

Action plan (step-by-step)

1) Check your revised State Pension award letter and note the new weekly amount and effective date.

2) Notify Pension Credit and request confirmation showing the updated figure.

3) Notify your council if you receive Housing Benefit or Council Tax Reduction.

4) Keep an income file with all letters and call logs.

5) If figures look wrong, ask for a recalculation or raise a complaint.

FAQs

Do arrears reduce Pension Credit? Pension Credit mainly assesses weekly income. One-off arrears are treated differently. Always notify DWP and keep decision letters.

Will my other benefits stop? It depends on your circumstances. Some benefits may adjust to your new pension amount.

Can Evanshaw help? Yes. We can check revised figures, advise who to notify, and help keep paperwork aligned.

Official links

Apply for HRP (CF411) — GOV.UK: https://www.gov.uk/guidance/apply-for-home-responsibilities-protection

Check State Pension forecast — GOV.UK: https://www.gov.uk/check-state-pension

Check NI record — GOV.UK: https://www.gov.uk/check-national-insurance-record

Pension Credit overview — GOV.UK: https://www.gov.uk/pension-credit