Step-by-Step: Claiming HRP via HMRC vs Using Evanshaw

When it comes to fixing missing Home Responsibilities Protection (HRP) years in your National Insurance record, you have two main options:

1. Submit the claim yourself directly via HMRC (the DIY route).

2. Use Evanshaw’s managed service (No Win, No Fee).

Both routes lead to the same destination — HMRC updating your record and the DWP reassessing your State Pension. But the experience, effort, and timeframe can be very different.

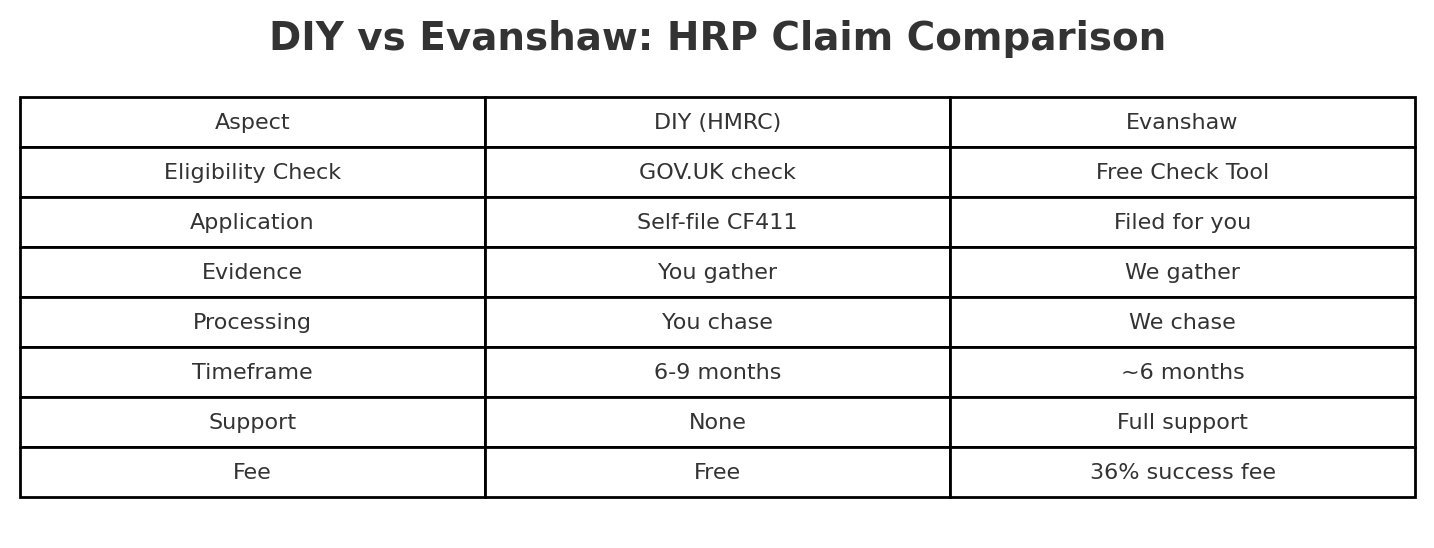

Quick Comparison

👉 **Want to skip straight to the easy option?** [Check your eligibility now with Evanshaw](https://evanshaw.co.uk/carer/check-now/)

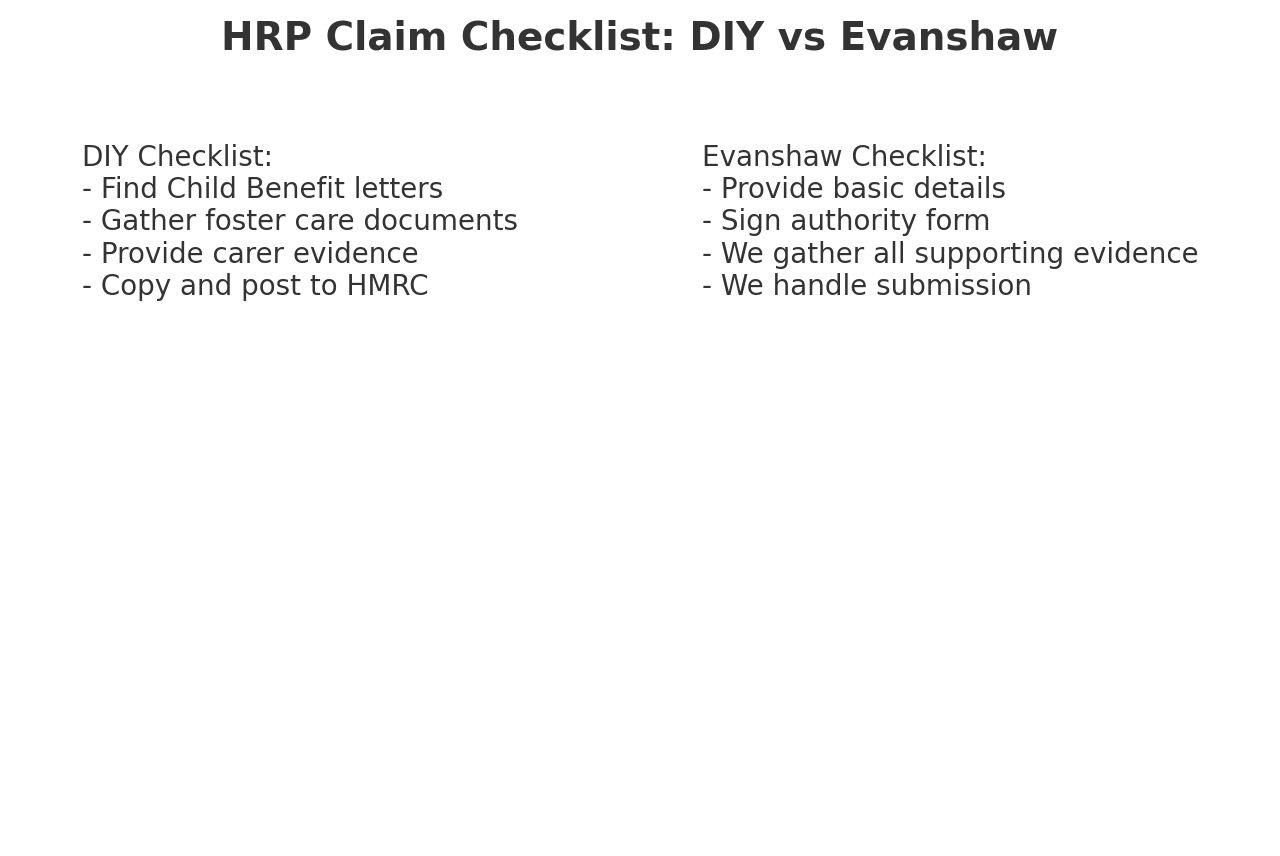

Step 1 – Eligibility Check

• HMRC DIY: You must log in and check your National Insurance record on GOV.UK: https://www.gov.uk/check-national-insurance-record

• Evanshaw: We provide a free ‘Check Now’ tool that instantly screens eligibility based on Child Benefit, caring responsibilities, and foster carer history.

Step 2 – Application

• HMRC DIY: Complete and post form CF411 with evidence, or apply online if you have digital copies ready: https://www.gov.uk/government/publications/national-insurance-home-responsibilities-protection

• Evanshaw: We complete and file CF411 on your behalf, ensuring all sections are correct and supported.

Step 3 – Evidence Gathering

• HMRC DIY: You must find and provide all evidence yourself (Child Benefit letters, foster carer confirmations, care allowance records, etc.).

• Evanshaw: We help identify what is needed, contact local authorities if necessary, and organise documents to meet HMRC standards.

Step 4 – HMRC Processing

• HMRC DIY: After submitting, you must chase HMRC for updates. Delays are common and can stretch processing to 9 months.

• Evanshaw: We handle all chasing and correspondence, ensuring HMRC respond and your claim does not fall into limbo.

Step 5 – DWP Pension Reassessment

Once HMRC corrects your NI record, DWP reassesses your pension. This step applies whether you claimed DIY or via Evanshaw, but our monitoring ensures it is followed through.

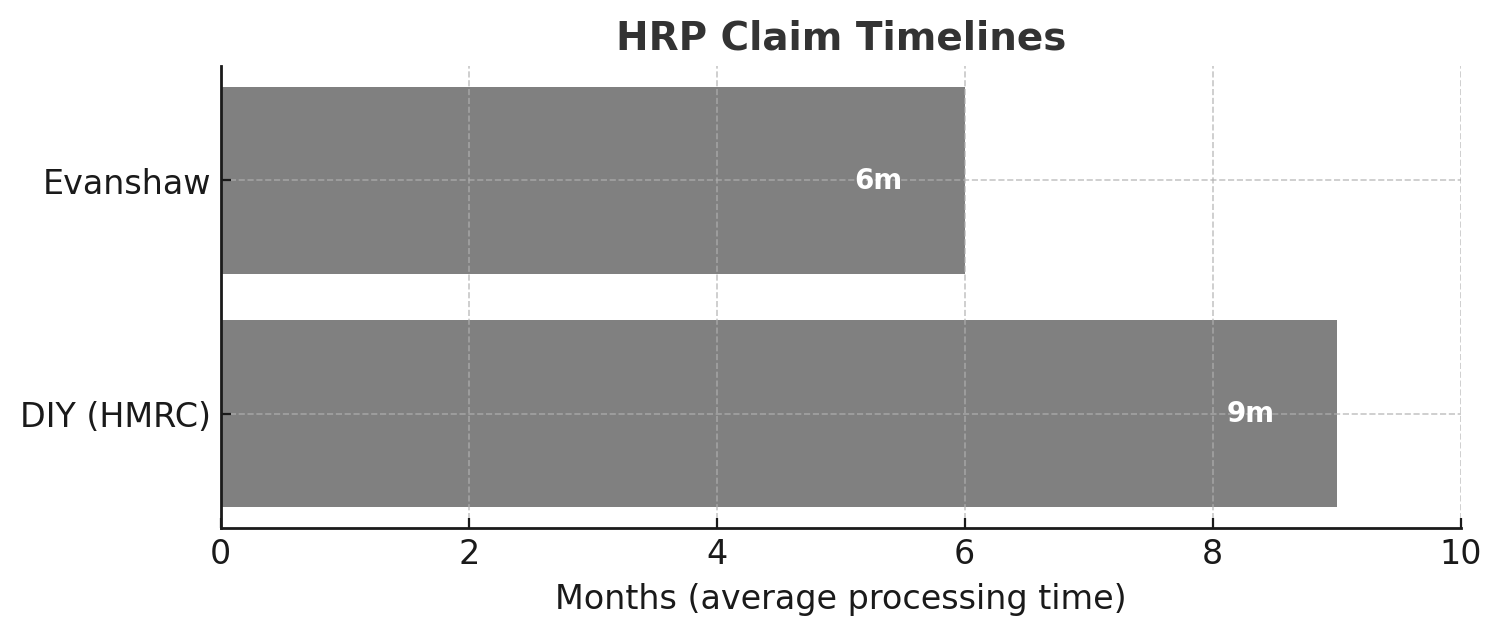

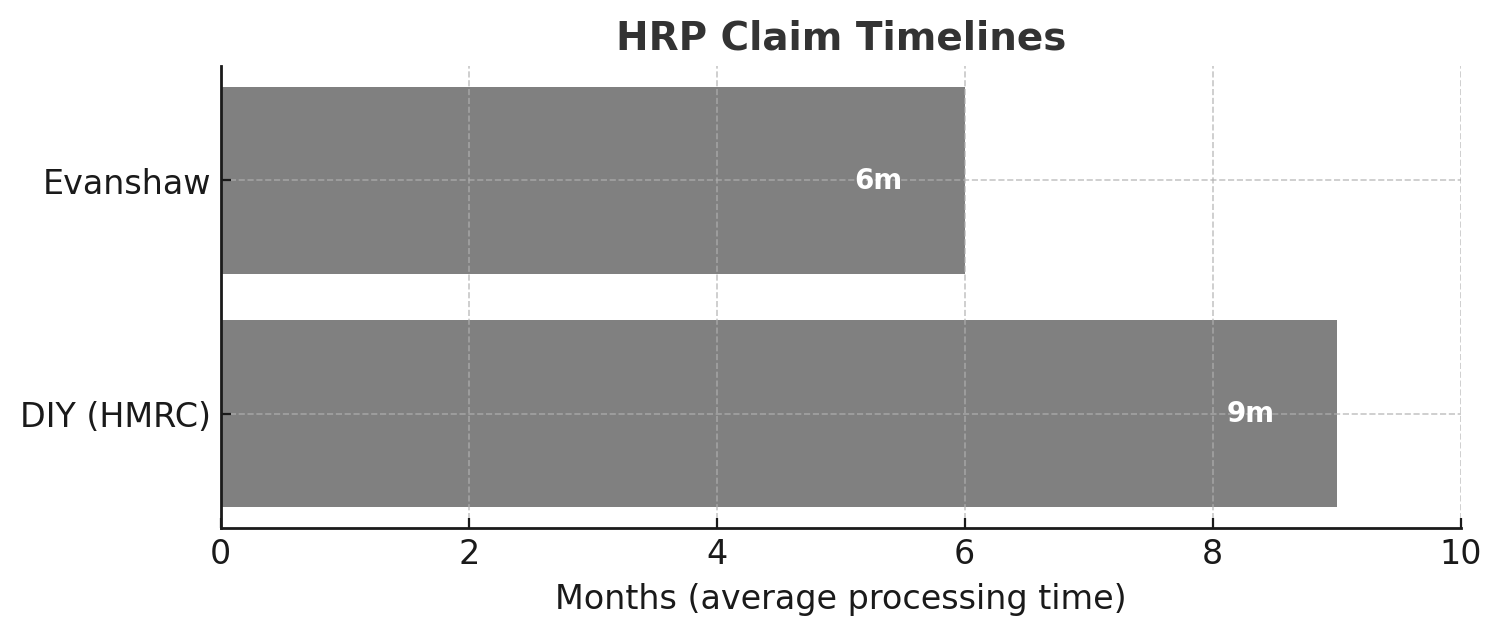

Expected Timeframes

• DIY: 6–9 months (varies, longer if HMRC request extra evidence).

• Evanshaw: Typically faster because claims are filed with complete documentation first time.

Note: Neither route can guarantee exact timeframes — HMRC workload is the key factor — but Evanshaw reduces the chance of delays caused by missing or incorrect paperwork.

Case Study: John’s Experience

John began his HRP claim directly with HMRC. He struggled to find foster care documentation and HMRC wrote back requesting more details. After months of delay, he switched to Evanshaw. We contacted his local authority directly, gathered the missing paperwork, resubmitted the CF411, and John’s record was corrected within 5 months. His State Pension was increased by £27 per week, and he received £6,400 in back payments.

Why choose Evanshaw?

- We only charge if successful (36% of arrears). See [our Fees](https://evanshaw.co.uk/fees.html).

- We manage evidence gathering and paperwork.

- We chase HMRC/DWP so you don’t have to.

- We have experience handling complex cases, including transfers and deceased claims.

- Review our [Terms & Conditions](https://evanshaw.co.uk/termsandconditions.html) for full details.

Frequently Asked Questions

Q: Can I start with HMRC and then switch to Evanshaw?

A: Yes. Many clients do this after facing delays.

Q: Is Evanshaw’s fee worth it compared to DIY?

A: Clients value time saved, reduced stress, and faster results. We only charge if your claim is successful.

Q: Does Evanshaw guarantee faster processing?

A: We can’t control HMRC’s workload, but by filing complete, organised claims we reduce avoidable delays.

Q: Can I still apply for free via GOV.UK?

A: Absolutely — GOV.UK is always free. See: https://www.gov.uk/national-insurance-home-responsibilities-protection

Final Step

👉 Ready to claim HRP? Use our free eligibility tool today: [Check Now](https://evanshaw.co.uk/carer/check-now/)

" id="description" rows="50" style="width:100%">

👉 **Want to skip straight to the easy option?** [Check your eligibility now with Evanshaw](https://evanshaw.co.uk/carer/check-now/)

Step 1 – Eligibility Check

• HMRC DIY: You must log in and check your National Insurance record on GOV.UK: https://www.gov.uk/check-national-insurance-record

• Evanshaw: We provide a free ‘Check Now’ tool that instantly screens eligibility based on Child Benefit, caring responsibilities, and foster carer history.

Step 2 – Application

• HMRC DIY: Complete and post form CF411 with evidence, or apply online if you have digital copies ready: https://www.gov.uk/government/publications/national-insurance-home-responsibilities-protection

• Evanshaw: We complete and file CF411 on your behalf, ensuring all sections are correct and supported.

Step 3 – Evidence Gathering

• HMRC DIY: You must find and provide all evidence yourself (Child Benefit letters, foster carer confirmations, care allowance records, etc.).

• Evanshaw: We help identify what is needed, contact local authorities if necessary, and organise documents to meet HMRC standards.

Step 4 – HMRC Processing

• HMRC DIY: After submitting, you must chase HMRC for updates. Delays are common and can stretch processing to 9 months.

• Evanshaw: We handle all chasing and correspondence, ensuring HMRC respond and your claim does not fall into limbo.

Step 5 – DWP Pension Reassessment

Once HMRC corrects your NI record, DWP reassesses your pension. This step applies whether you claimed DIY or via Evanshaw, but our monitoring ensures it is followed through.

Expected Timeframes

• DIY: 6–9 months (varies, longer if HMRC request extra evidence).

• Evanshaw: Typically faster because claims are filed with complete documentation first time.

Note: Neither route can guarantee exact timeframes — HMRC workload is the key factor — but Evanshaw reduces the chance of delays caused by missing or incorrect paperwork.

Case Study: John’s Experience

John began his HRP claim directly with HMRC. He struggled to find foster care documentation and HMRC wrote back requesting more details. After months of delay, he switched to Evanshaw. We contacted his local authority directly, gathered the missing paperwork, resubmitted the CF411, and John’s record was corrected within 5 months. His State Pension was increased by £27 per week, and he received £6,400 in back payments.

Why choose Evanshaw?

- We only charge if successful (36% of arrears). See [our Fees](https://evanshaw.co.uk/fees.html).

- We manage evidence gathering and paperwork.

- We chase HMRC/DWP so you don’t have to.

- We have experience handling complex cases, including transfers and deceased claims.

- Review our [Terms & Conditions](https://evanshaw.co.uk/termsandconditions.html) for full details.

Frequently Asked Questions

Q: Can I start with HMRC and then switch to Evanshaw?

A: Yes. Many clients do this after facing delays.

Q: Is Evanshaw’s fee worth it compared to DIY?

A: Clients value time saved, reduced stress, and faster results. We only charge if your claim is successful.

Q: Does Evanshaw guarantee faster processing?

A: We can’t control HMRC’s workload, but by filing complete, organised claims we reduce avoidable delays.

Q: Can I still apply for free via GOV.UK?

A: Absolutely — GOV.UK is always free. See: https://www.gov.uk/national-insurance-home-responsibilities-protection

Final Step

👉 Ready to claim HRP? Use our free eligibility tool today: [Check Now](https://evanshaw.co.uk/carer/check-now/)